Does your investing ecosystem look like meteorological chaos? Remember the three R's — Randomness Ruins Riches. You may recall Warren Buffett saying that he doesn't invest in anything he can't explain to a 10 year old. So here's my Buffett 3-R Challenge to you.

Explain your investing strategy, methodology and plan to a fellow investor you respect. If they can make sense of it and not get lost in the details, chances are you won't either. If it's too complex for others to understand, chances are high that you, too, will get lost in your own financial maze.

The metaphor I'll use for this challenge is airports where we all have experienced frustrating times. When traveling, have you ever wondered why every airport is so dissimilar to every other airport? Why haven't airport architects finally hit upon the ideal design? The best layout that will optimize all aspects of flying for both airlines and passengers?

Here's why:

Consider Washington Dulles. Basically, two very long parallel corridors. Then there's San Francisco International which is completely different with it's rounded hub and numerous legged spokes. And can someone please explain to me who ever designed the seemingly arbitrary hologram that's Chicago O'Hare?

My point is that most airports configurations work well enough. In reality, most investment methodologies work well enough with the caveat that if you have the discipline to remain loyal to the design and not let your corrosive emotions overwhelm your methodology, you'll likely make money. As an individual investor, you are literally permitted to design the airport of your dreams — your personal framework of corridors, hubs and spokes that will all work as one because you know it intimately.

Good luck if you should meander into someone else's airport. The result is increased stress, missed flights and lost luggage. Similar to those detailed airport maps we all search out, I challenge you as an investor to draw and sketch out a similar map of your investing airport.

Now remember those three Ps? Preparation Pays Profits. I'll share with you my airport map in a bit, but please consider that I've spent decades studying, teaching, trading and laboring to assemble an investment roadmap that has worked nicely for me. Not to sound glib, but making profits quickly takes time.

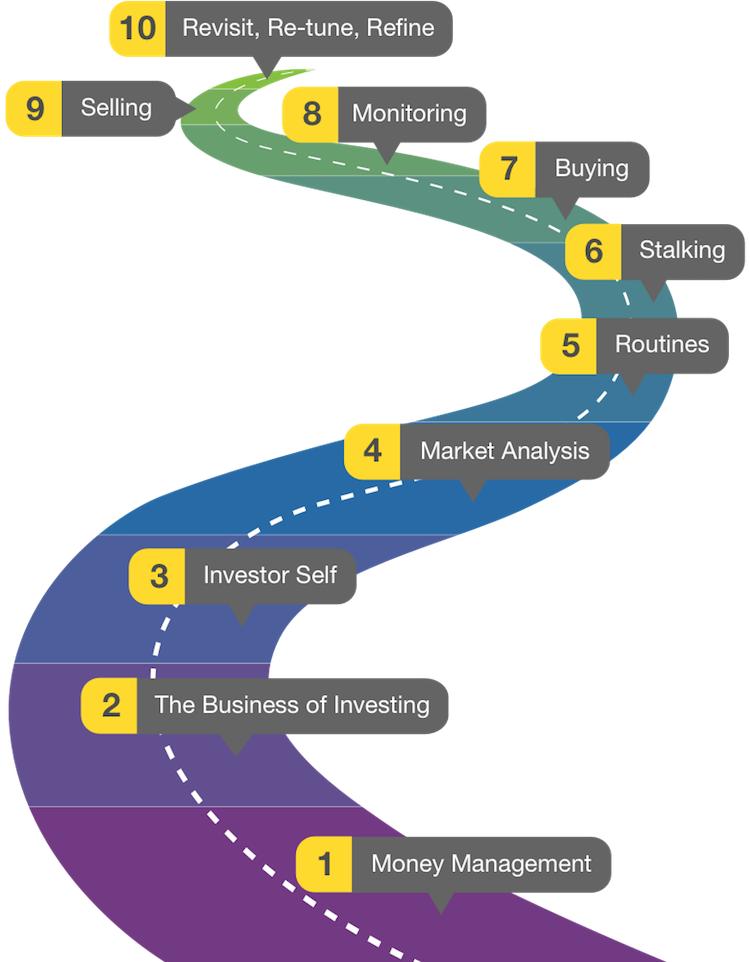

Bear in mind that successful portfolio management is always evolving. Investing needs to be a 360-degree activity. What's in front and in back and all around you matters. It's like real life — it's never simply black and white. In reality, investing is very personal. There is not just one best way to design a portfolio and investment plan — much like airport design. So back to basics. Here is the roadmap I designed and we presented in our book, Tensile Trading: The 10 Essential Stages of Stock Market Mastery. How does your plan compare?

One Last Note...

In closing, I should let you know that the detailed presentation of these ten stages is now available for a 50% off discount in a two-disc Blu-ray format. Click Here to check it out and pick up a copy in The StockCharts Store. Alongside the Tensile Trading book itself, the two pack a pretty serious punch and give you a complete understanding of how Grayson and I invest and trade the markets successfully.

March 21: "Mastering The Stock Market At All Ages"

Next month, Grayson and I will be presenting in Los Angeles to the AAII about "Mastering The Stock Market At All Ages". In this special event, we're taking over for a full morning (9:00am - noon) with three mini presentations designed to bring young and older investors together into the same room. We'll share how we manage our money, how we invest both separately and together, and discuss the most important lessons that we've learned as a father-son investing team with over 45 years of combined experience.

For more information about the event or to register, CLICK HERE.

Trade well; trade with discipline!

Gatis Roze, MBA, CMT

- Author, "Tensile Trading: The 10 Essential Stages of Stock Market Mastery" (Wiley, 2016)

- Developer of the "Stock Market Mastery" ChartPack for StockCharts members

- Presenter of the best-selling "Tensile Trading" DVD seminar

- Presenter of the "How to Master Your Asset Allocation Profile DVD" seminar