Welcome to the recap of today's MarketWatchers LIVE show, your antidote for the CNBC/FBN lunchtime talking heads. Listen and watch a show devoted to technical analysis of the stock market with live market updates and symbols that are hot. You'll find the latest episode here.

Welcome to the recap of today's MarketWatchers LIVE show, your antidote for the CNBC/FBN lunchtime talking heads. Listen and watch a show devoted to technical analysis of the stock market with live market updates and symbols that are hot. You'll find the latest episode here.

Information abounds in our Monday through Friday 12:00p - 1:30p shows, but the MWL Blog will give you a quick recap. Be sure and check out the MarketWatchers LIVE ChartList for many of today's charts.

Your comments, questions and suggestions are welcome. Our Twitter handle is @MktWatchersLIVE, email is marketwatchers@stockcharts.com and our Facebook page is up and running so "like" it at MarketWatchers LIVE. You'll also find archives of our shows on our Facebook page and YouTube channel. Don't forget to sign up for notifications at the end of this blog entry by filling in your email address.

**UPCOMING SCHEDULE**

Saturday (12/9) at 11:00a EST - "StockCharts Outlook" webinar with Greg Schnell and Arthur Hill

Wednesday (12/13) - Guest, Arthur Hill

Friday (12/15) - Tom Bowley's Workshop (subject TBA)

What Happened Today?

Technical News: Tom Bowley reveals the latest economic reports, earnings, upgrades and downgrades. Lots of economic news today. Monthly non-farm payrolls came in at 228,000 and the market was expecting 190,000 which is a beat. Private payrolls were 221,000 v. 184,000 the market was expecting. Unemployment rate is unchanged at 4.1%. Average Hourly Earnings rose 0.2% but the market was expecting 0.3%. December consumer sentiment index is at 96.8 for preliminary December reading which is positive but not as high as October's peak of 100.7. October Wholesale Trade inventories are getting off to a slow start in the fourth quarter as those at the wholesale level fell a sizable 0.5 percent in October when the market was expecting only a 0.1% drop. In general, along with a rising treasury yield, the bond market is waiting on the Fed. Biggest concern will be what the Fed says they are going to do with all of the Bonds bought during QE and we should hear about that next week after the Fed meeting.

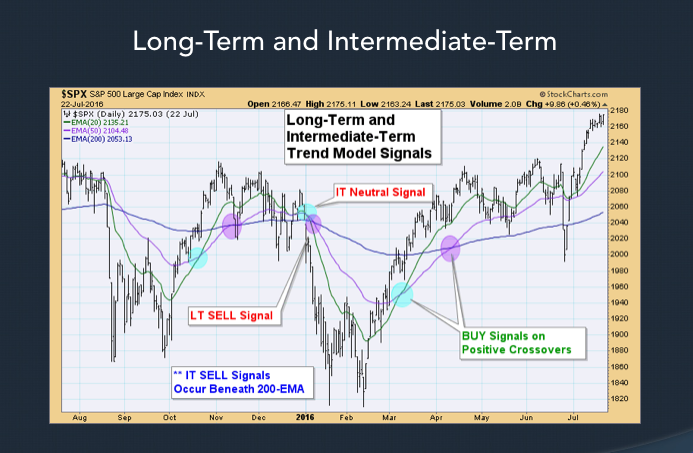

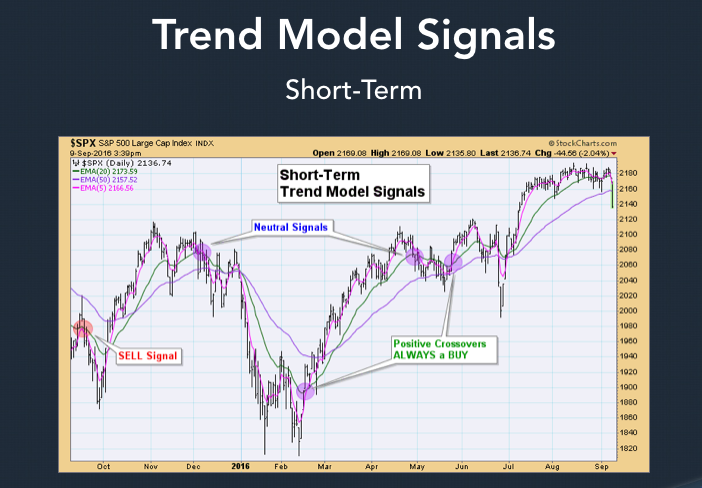

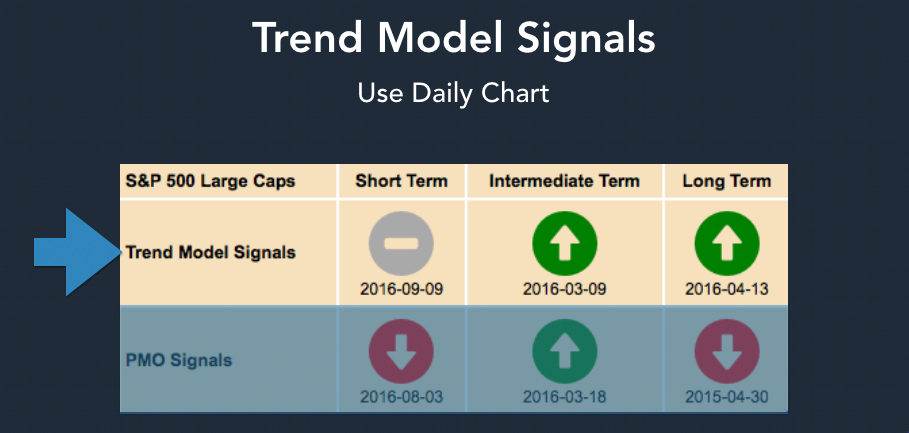

DecisionPoint Trend Models Workshop: Erin presented a workshop on the DP Trend Models, explaining how they are calculated and their uses. Important points/questions: DP uses EMAs in order to put weighting and emphasis on the most recent price action. The Trend Models are lagging because they are based on moving average crossovers so you need to get more information from the chart and not only use these signals. You should consider reading Erin's article from last Wednesday which addresses the uses of the Long-Term Trend Model to determine bull or bear market bias. Below are her slides. To see "real-life" current chart examples and explanations on trading with these models, you really should watch the recording.

Ten in Ten Before One: In this regular segment, Tom reviews ten charts in ten minutes with Erin's comments and comments from the Twitter "peanut gallery" peppered in there. Send in your symbol requests via Twitter (@mktwatcherslive) before the show and we'll try and add them. Symbols reviewed today: TRN, CVS, UCTT, SLV, IMGN, CTRL, DGX, EXAS, TDOC and NVDA. You'll find all of the charts in the MarketWatchers LIVE ChartList, located at the top of the MarketWatchers blog homepage.

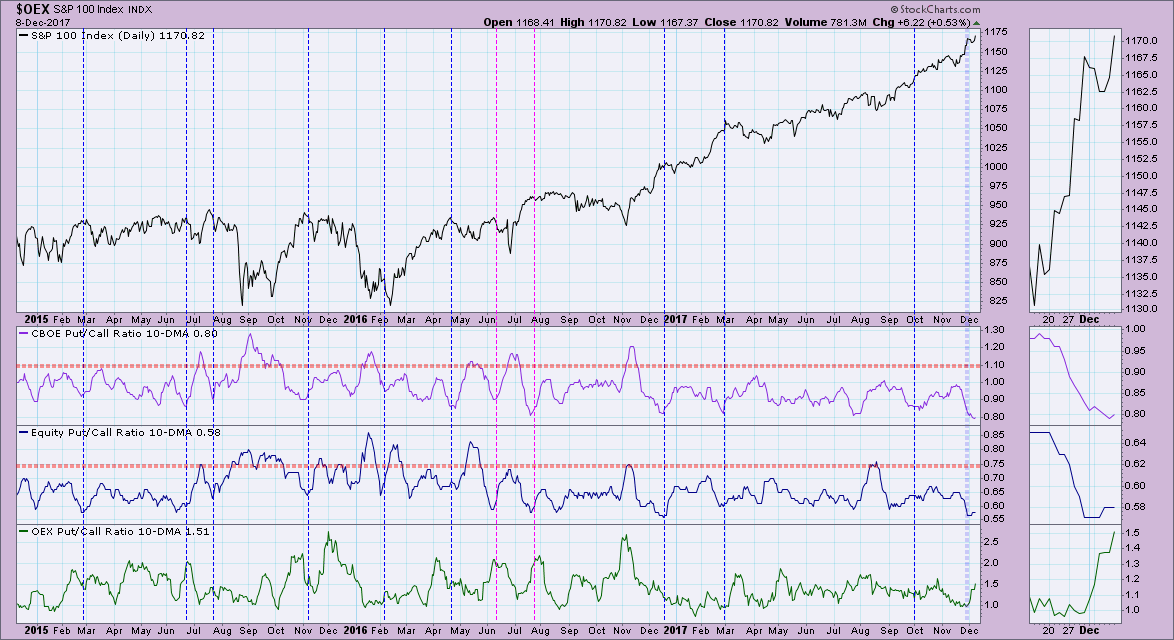

Sentiment Update: Erin gave us a sentiment update. The 10-DMA of the put/call ratio chart shows very low ratio which indicates excessive bullishness on CBOE and Equity ratios. OEX put/call ratio is usually running contrary since big money often uses these to hedge. Seeing such excessive bullishness suggests a pullback or decline coming; although as you can see, since mid-2016 it has resulted in sideways consolidation and not a corrective move or deep decline.

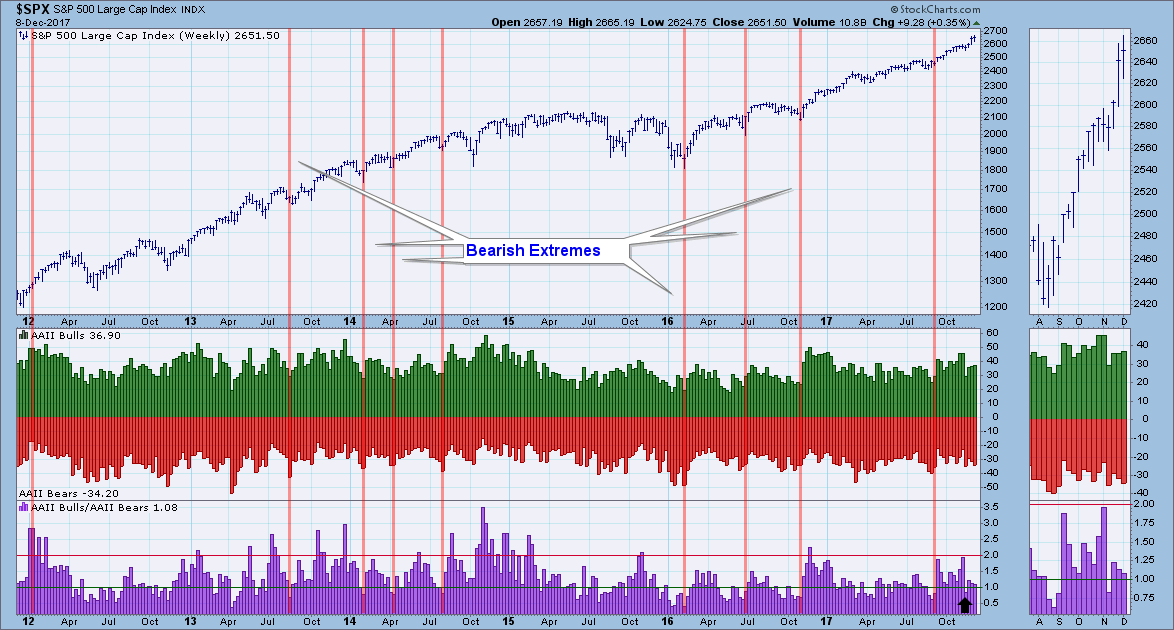

Nothing much to say here. We look for extremes in one direction or the other and there isn't one right now.

Nothing much to say here. We look for extremes in one direction or the other and there isn't one right now. NAAIM pulled back exposure which could also suggest some downside or consolidation.

NAAIM pulled back exposure which could also suggest some downside or consolidation.

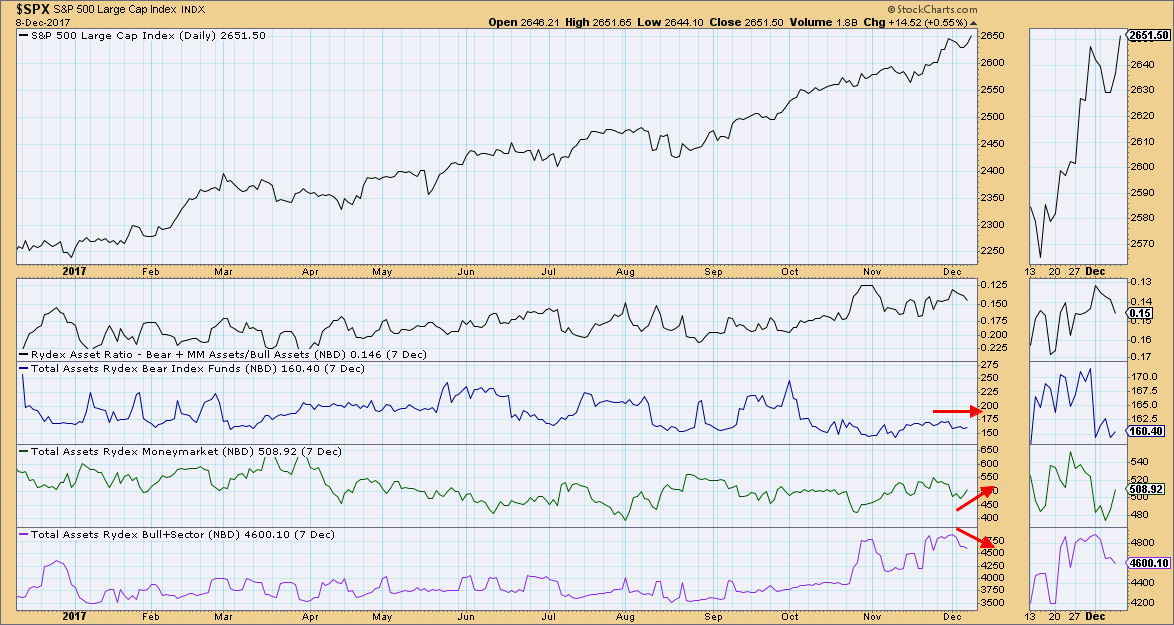

Rydex analysis suggests that money is being added to money markets (cash), but it isn't moving into either bull or bear funds...in fact money is coming out of bull funds which suggests to me there is some profit taking occurring before the holidays.

Rydex analysis suggests that money is being added to money markets (cash), but it isn't moving into either bull or bear funds...in fact money is coming out of bull funds which suggests to me there is some profit taking occurring before the holidays.

Mailbag: We've had a lot of questions coming in asking about watching old shows. The links are actually at the bottom of this article. You can see the latest episode by clicking on the webinar tab on StockCharts or you can go to our MarketWatchers LIVE Facebook page to see archived shows. Additionally, you can watch past and recent shows on the StockCharts YouTube channel. We're glad you're enjoying the program!

It's a Wrap! This week's sentiment poll for Tom and Erin showed they are in disagreement. Erin believes the market will finish higher next week, while Tom believes it will finish mostly unchanged. What do you think? Our viewer poll will be open on Twitter until showtime on Monday at noon EST.

Looking Forward:

Tune in on Monday at 12:00p - 1:30p EST on 12/11 for Monday Set-Ups. Tom and Erin will discuss which charts look hot or not for the upcoming week.

The regular segments, Ten in Ten to One and Mailbag are also on tap for Monday, where we look at your recent questions and symbol requests.

Don't miss it!!

Helpful MarketWatchers LIVE Links:

Facebook - MarketWatchers LIVE Page

YouTube Channel for StockCharts

PMO -Price Momentum Oscillator