Interruptions in the unfolding decline struture - should amount to nothing more than intervening rebounds within context of the unfolding decline. Aside what we've discussed all week (including sticking with Thursday's 2115 June S&P / E-mini short-sale); there were developments Saturday than enhance a decision made to retain (part or all) of that short over the weekend (detailed).

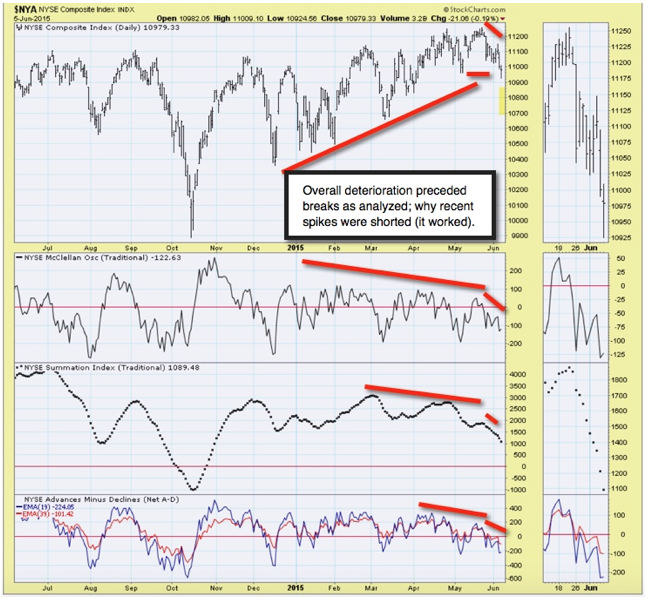

Technically - the stock market is sitting exactly where we expected; eroding as periodic rebounds try to forestall what seemingly is an inevitable breaking of the 'trading range' (roughly between 2070-80 and 2120-30 basis June S&P). In this process the primary uptrend (details reserved in fairness to members).

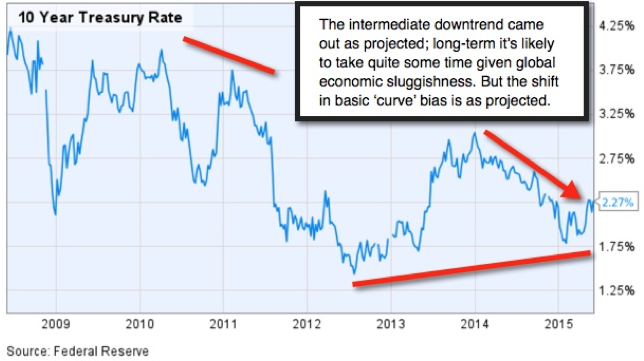

That's important, as my view was that the prior day's IMF 'clarion panic call' for the Fed to back-off plans to reduce stimulus or tighten, was a reaction to what must have been a rejection of such private pleas to the Fed in advance. The IMF would likely never have gone public otherwise in such a public manner.

Bottom-line: the downtrend interspersed by unsustainable rebounds evolves. At the moment the short-sale from Thursday remains live (in-whole or in-part), from the 2115 E-mini / June S&P level. Suspect a bit lower before (redacted).

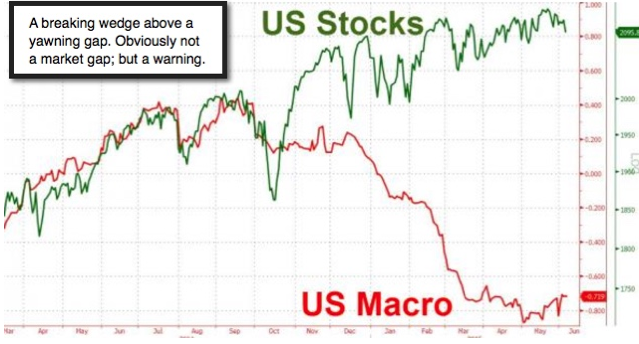

(Macro) action - wishes to emphasize two more points; aside surrendering the old S&P trading range (and proximity of the 100-day Moving Average).

We hold short June S&P (continuing inflection position-posture) from 2131, as well as live trading (besides additional scalps for hit-and-run players) and the official 'live' guideline from 2115 this past Thursday has also been retained.

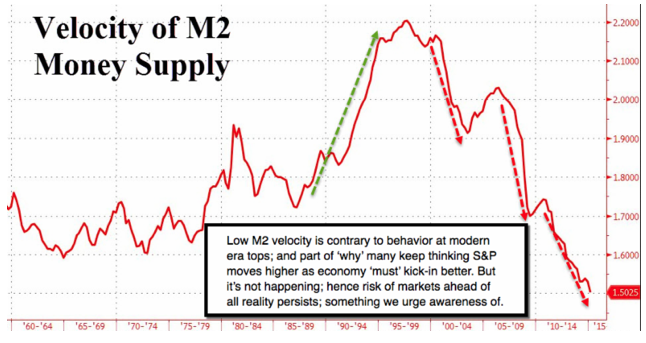

Reduced 'capital formation' - is about the last thing the Federal Reserve of course expected after their repeated rounds of stimulus; but is what they got. (We reiterate a simple gander at the M2 'Velocity' of money as evidence.)

That lack of M2 'velocity' suggests we are still in (or going back into) a sort of recession rather than the huge buying binge the bulls keep counting on.

Bottom-line: the internal top's been behind for weeks; not a new technical development. Rallies appear(ed) to be efforts to forestall technical breakdown threatened many times in recent weeks; not affirmations of bullish structures.

Treacherous times. The process evolves.

Enjoy the trading week!

Gene

Gene Inger

www.ingerletter.com