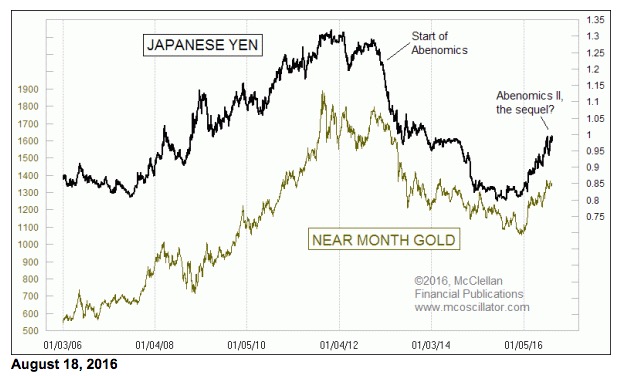

You might have to be a real inter-market analysis geek to know this, but for the past several years the fortunes of gold prices have been inexorably tied with those of the Japanese yen. So to get a real gold decline, it makes sense that we should expect to also see a big drop in the value of the yen.

That ought not to be that hard to achieve. The Bank of Japan (BoJ) is working hard on its own version of QE, spewing more yen onto their banking system. And we just learned on Aug. 17 that Japan’s exports sank 14% from a year ago, and its imports dropped even further, at 24%. With a weakening economy like that, surely the yen should weaken, no?

Not so far. We are in Strangeville now, a time when word of the FOMC contemplating rate hikes causes a rally in both stock and bond prices, and when word of a slowing economy in Japan is seen as good news for the yen.

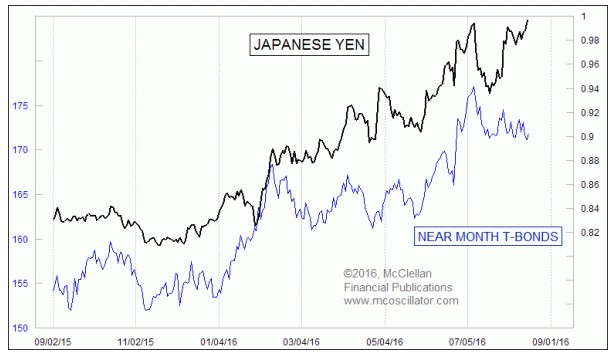

The yen’s movements have also been correlating with T-Bond prices, except that bonds have not been keeping up with the yen’s rebound back to its prior high.

Given how they normally correlate, one or the other is “wrong”. Either the yen is wrong for surging ahead without support, or T-Bond prices are “wrong” for not keeping up when they are supposed to, and thus will have to work extra hard in the coming weeks to make up for lost time.

My bet is on PM Abe stoking another round of “Abenomics” to push down the yen in order to help exports, and thus also to hurt gold and T-Bonds.

Tom McClellan

The McClellan Market Report

www.mcoscillator.com