SPX Monitoring Purposes: Long SPX on 1/18/24 at 4780.94.

Our Gain 1/1/23 to 12/31/23: SPX=28.12%; SPX gain 23.38%.

Monitoring Purposes GOLD: Long GDX on 10/9/20 at 40.78.

Our gain for 2023 came in at 28.12% and SPX gain for 2023 came in at 23.38. We made 8 SPX trades, with one loss and 7 wins in 2023.

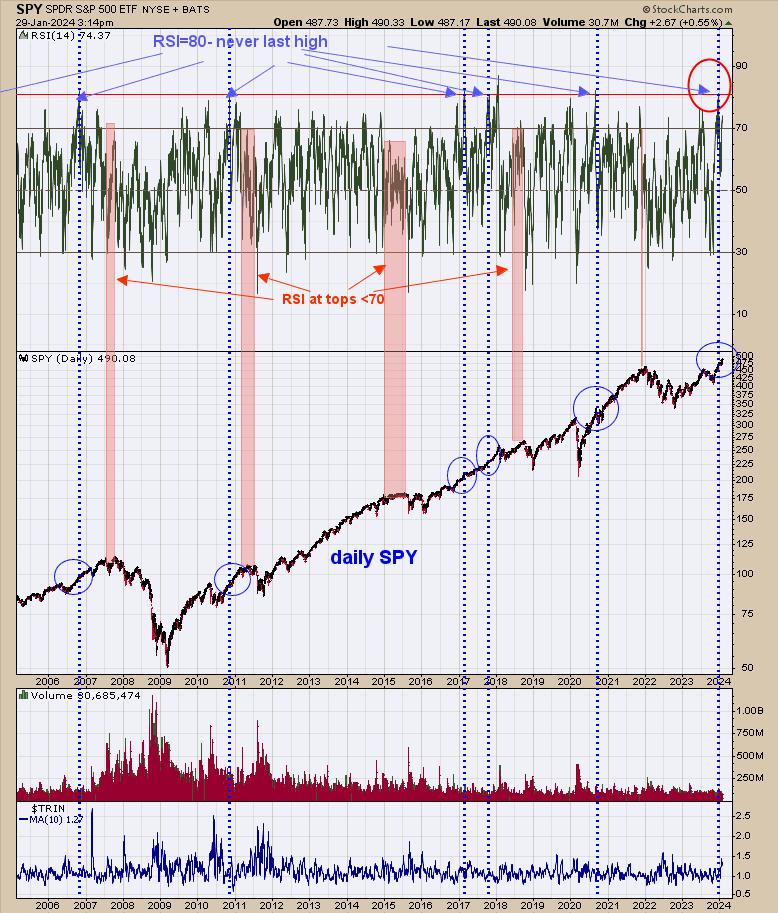

We have the SPY up six days in a row going into last Thursday, which predicts that the SPY will be higher within five days 93% of the time. The top window is the 10-day average of the TRIN, which stands at 1.27; readings above 1.20 are considered bullish. The window below daily SPY is the 21-day TRIN; reading above 1.20 are bullish (current reading is 1.22). SPY tends to trend when both 10- and 21-day TRIN are in bullish levels (noted in shaded pink). In general, the SPY (SPX) rally should continue.

We updated this chart from last Thursday. Back then, we said, "SPY (SPX) may be starting to trend (market is consistently up every week). The above is daily SPY going back to 2005. The top window is the RSI for the SPY. It's common for the market to trend when the daily RSI trades to 80. We market those times when the RSI reached 80 with dotted blue lines. The RSI reached 80 on December 18, 2023 (about a month ago). In previous times when the RSI reached 80, the market trended for multiple months." This more evidence that a trending market is likely.

Tim Ord,

Editor

www.ord-oracle.com. Book release "The Secret Science of Price and Volume" by Timothy Ord, buy at www.Amazon.com.

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. Opinions are based on historical research and data believed reliable; there is no guarantee results will be profitable. Not responsible for errors or omissions. I may invest in the vehicles mentioned above.