Possibly a long-term bottom. But I do respect bearish market behavior, especially during the summer months where history tells me "corrections happen".

I'm watching the action closely today, however, and we're seeing significant bounces off of steep drops that have a rather distinct market maker odor to them. Take the semiconductor stocks as a perfect example:

As you can see, we've been heading lower in the semiconductor space since early June with more than a 10% correction during that span. We still have a couple more hours left in today's action and a lot can happen technically in the stock market in two hours, but a strong finish would suggest additional strength in this area at least in the very near-term. Then the question will become can this group clear its downtrending 20 day EMA? But as I review the semiconductors, I can't help but notice the recoveries in some of the bigger semiconductor names at key price support levels. Check out these component charts:

Intel (INTC):

Applied Materials (AMAT):

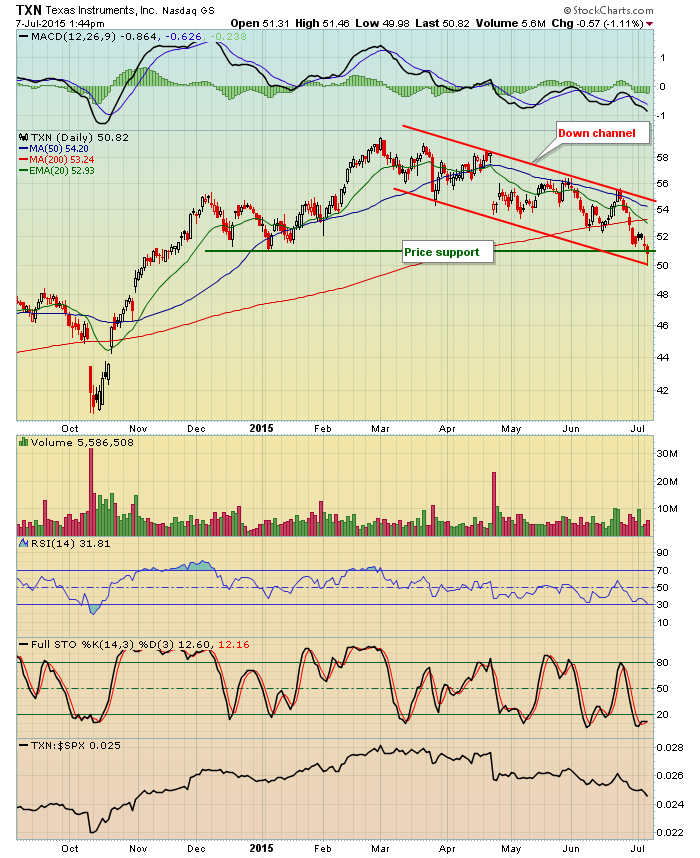

Texas Instruments (TXN):

From looking at the above charts, it's fairly easy to see that these stocks - and semiconductors as a whole - have been lagging the performance of the S&P 500 badly throughout much of 2015. Depending upon which stock you focus on, the relative strength began deteriorating in the January to March time frame. There's also no denying, however, that each of these critical semiconductor stocks seem to be at a critical juncture on their charts. Both INTC and AMAT are testing very important October lows. If you're bullish the stock market, you'd much rather see these two visible semiconductor companies holding support from a major low in October.

This is just a sample of the key tests the technology bulls are faced with as earnings season approaches.

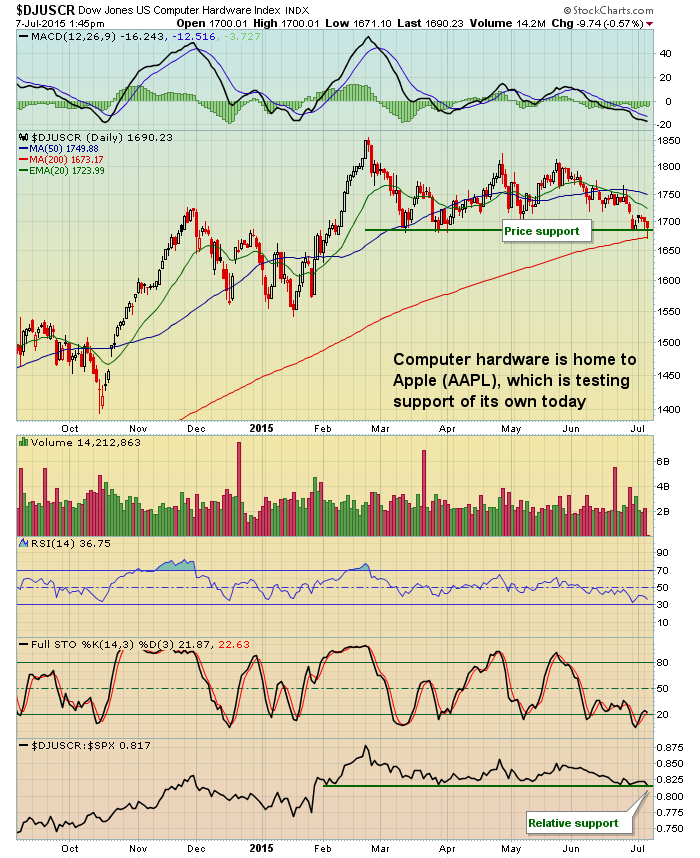

Check out computer hardware ($DJUSCR):

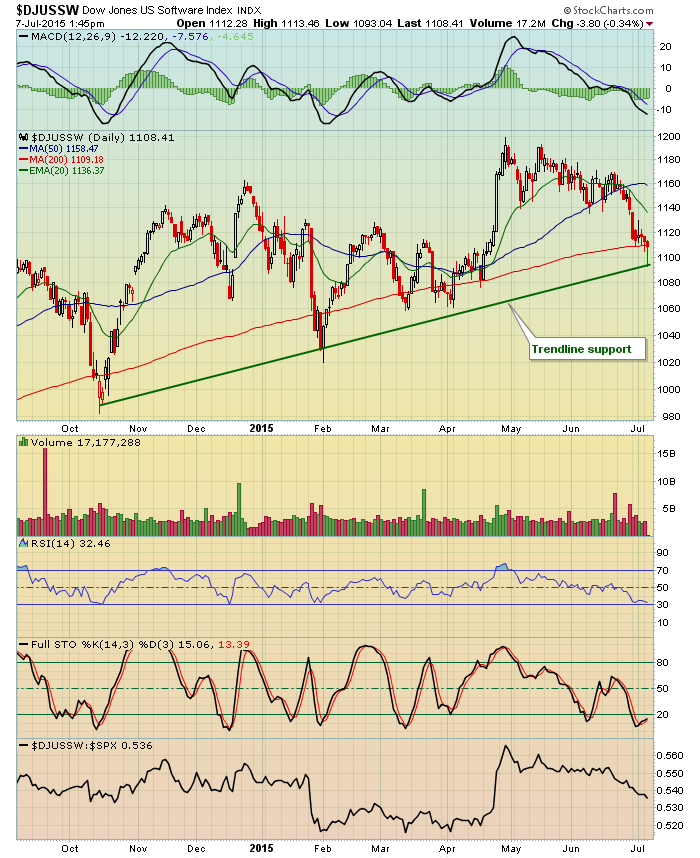

......and then software ($DJUSSW):

Technology stocks (XLK) have been behaving poorly since topping in late May. There's nothing wrong with underperforming for a period of time as money rotates within a bull market. Problems do develop, though, when technical breakdowns - especially price breakdowns - begin to occur. That's what I'm focused on today. How do we close? Do more and more sectors and industry groups move to a technical sell signal? I don't expect that this bull market rally has ended, but I don't fight the charts. And I know July begins a treacherous historical performance stretch for equities as well.

A solid finish into today's close and we've probably just witnessed more market maker games and manipulation. Another selloff, however, could be a very different story.

Happy trading!

Tom