Trading Places with Tom Bowley January 31, 2018 at 08:45 AM

Market Recap for Tuesday, January 30, 2018 This day was a long time coming. The U.S. stock market's uninterrupted surge to record all-time highs day after day, week after week and month after month needed a break. It needed relief. Yesterday that relief was found...... Read More

Trading Places with Tom Bowley January 30, 2018 at 08:40 AM

Market Recap for Monday, January 29, 2018 We saw something different in the U.S. stock market on Monday. We closed in negative territory on all of our major indices and we closed at or near lows for the day. There was little or no bargain hunting at the end of the session... Read More

Trading Places with Tom Bowley January 29, 2018 at 08:40 AM

Market Recap for Friday, January 26, 2018 The bears were absolutely stymied on Friday as the major indices surged to unprecedented levels... Read More

Trading Places with Tom Bowley January 26, 2018 at 08:40 AM

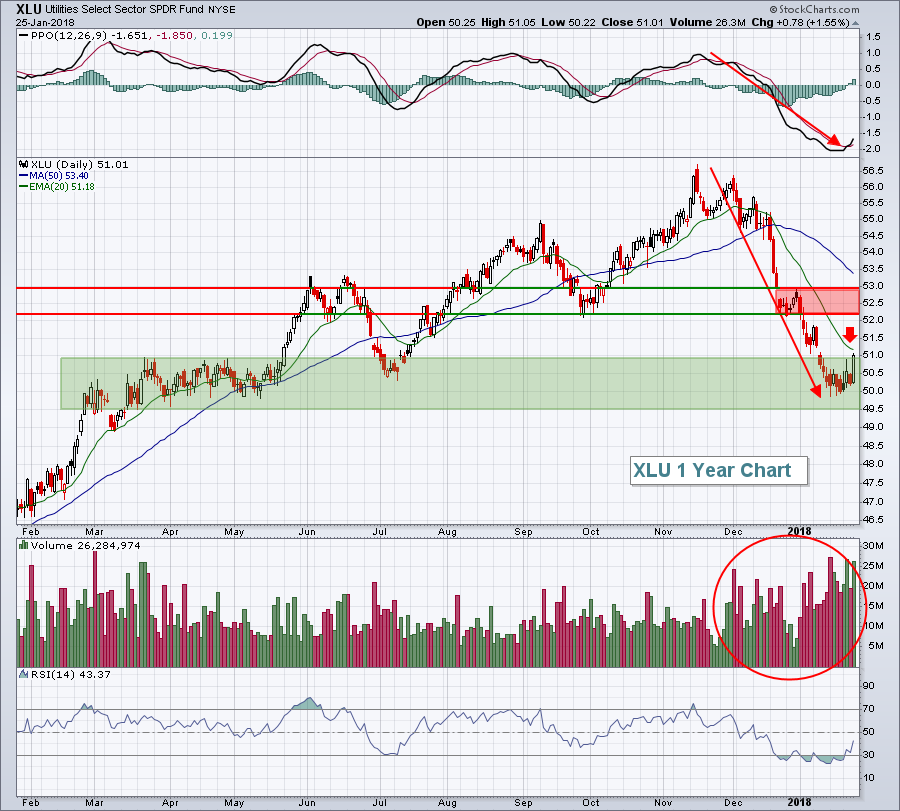

Market Recap for Thursday, January 25, 2018 Utilities (XLU, +1.55%) easily enjoyed its best day of 2018 on Thursday as significant price support, combined with falling treasury yields, triggered an explosive move higher as buyers could not get enough of the beaten-down sector... Read More

Trading Places with Tom Bowley January 25, 2018 at 09:00 AM

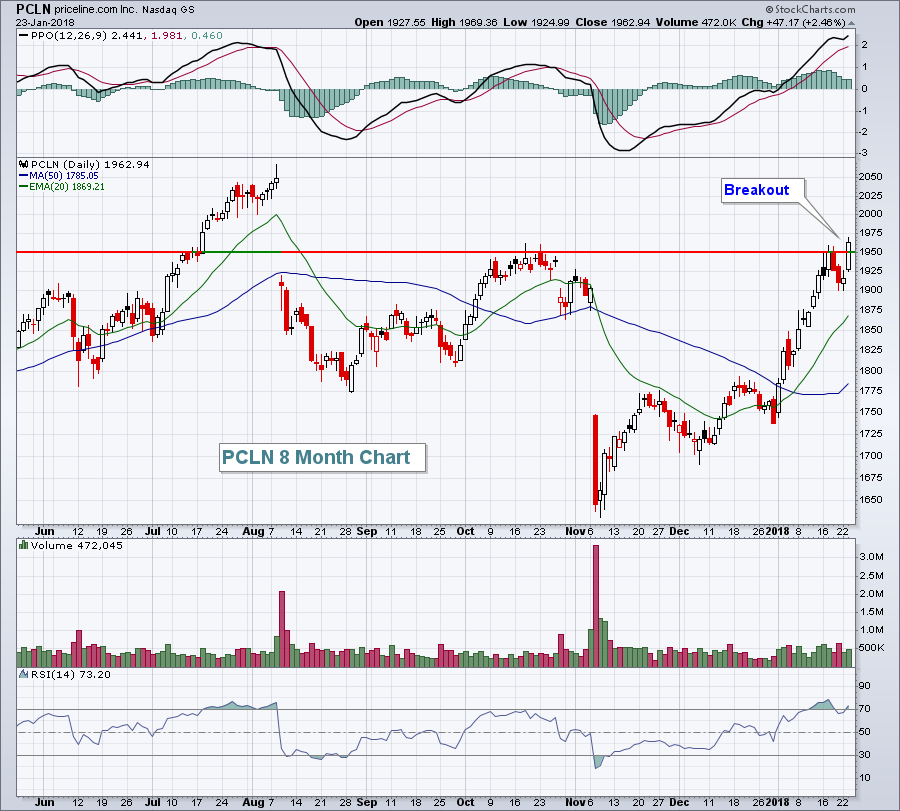

Market Recap for Wednesday, January 24, 2018 Only the Dow Jones was able to end Wednesday's session in positive territory, but all of our major indices remain very strong with accelerating bullish price momentum. Sectors and industries have taken their turns leading U.S... Read More

Trading Places with Tom Bowley January 24, 2018 at 08:49 AM

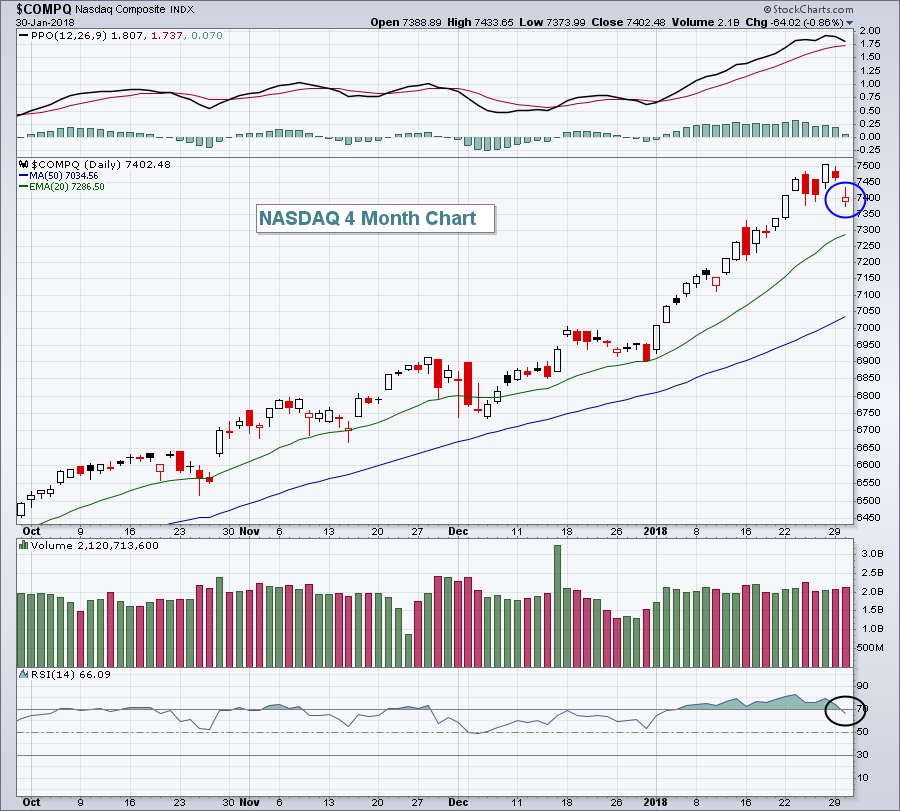

Market Recap for Tuesday, January 23, 2018 The tech-laden NASDAQ powered forward to new all-time highs on Friday, closing above 7400 for a second consecutive session and now approaching 7500... Read More

Trading Places with Tom Bowley January 23, 2018 at 08:45 AM

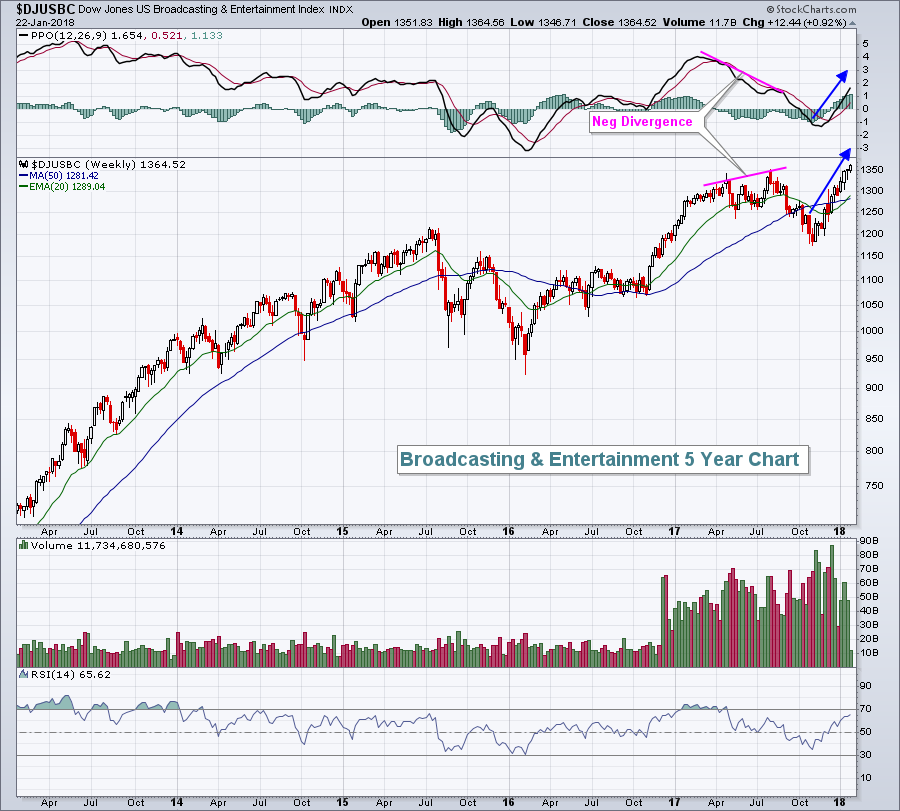

Market Recap for Monday, January 22, 2018 There was a lot of good things happening on Monday. First of all, one of the worst days historically has been the Monday after options expiration Friday... Read More

Trading Places with Tom Bowley January 22, 2018 at 08:30 AM

Market Recap for Friday, January 19, 2018 Strength resumed on Friday, with three of our four major indices closing at record highs... Read More

Trading Places with Tom Bowley January 19, 2018 at 09:00 AM

Market Recap for Thursday, January 18, 2018 Thursday was not a great day for the bulls. We haven't seen too many times since the August low where all of our major indices finished lower on the session. Yesterday, however, was one of those days... Read More

Trading Places with Tom Bowley January 18, 2018 at 09:00 AM

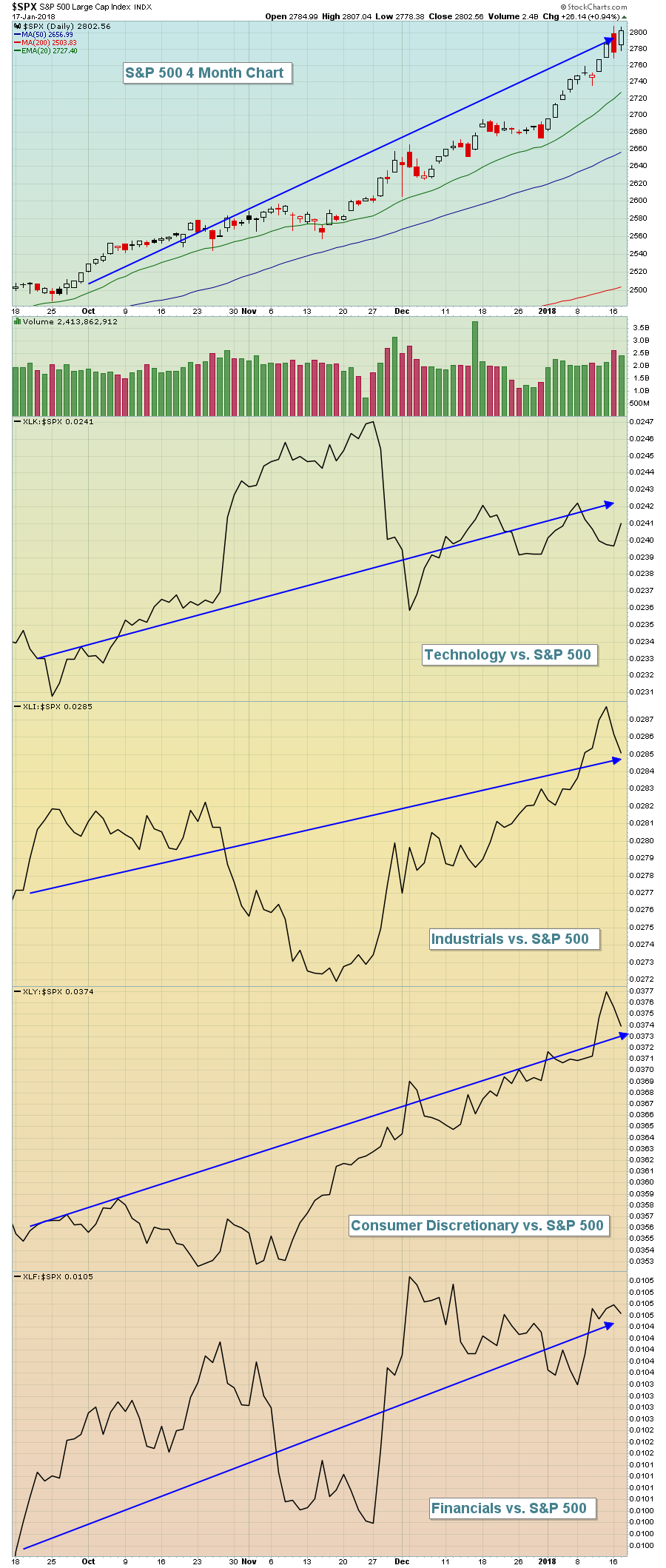

Market Recap for Wednesday, January 17, 2018 The Dow Jones didn't fail this time. After Tuesday's huge reversal from above the 26,000 level, there were a number of question marks about whether the current rally would continue... Read More

Trading Places with Tom Bowley January 17, 2018 at 09:00 AM

Market Recap for Tuesday, January 16, 2018 Tuesday was perhaps the most bearish day we've seen in quite awhile. For starters, volume on our major indices was the heaviest in the past 6-7 weeks, excluding option expiration Friday on December 15th... Read More

Trading Places with Tom Bowley January 16, 2018 at 08:31 AM

Market Recap for Friday, January 12, 2018 U.S. equities had another nice rally on Friday, this time led by a very strong consumer discretionary sector (XLY, +1.29%). Eight of the nine sectors finished higher, with utilities (XLU, -0.57%) the only area failing to participate... Read More

Trading Places with Tom Bowley January 12, 2018 at 09:00 AM

Market Recap for Thursday, January 11, 2018 The small cap Russell 2000 ($RUT) led U.S. indices higher on Thursday with more across-the-board record highs being set. The RUT gained 1.73%, more than doubling the advance on any of the other major indices... Read More

Trading Places with Tom Bowley January 11, 2018 at 09:00 AM

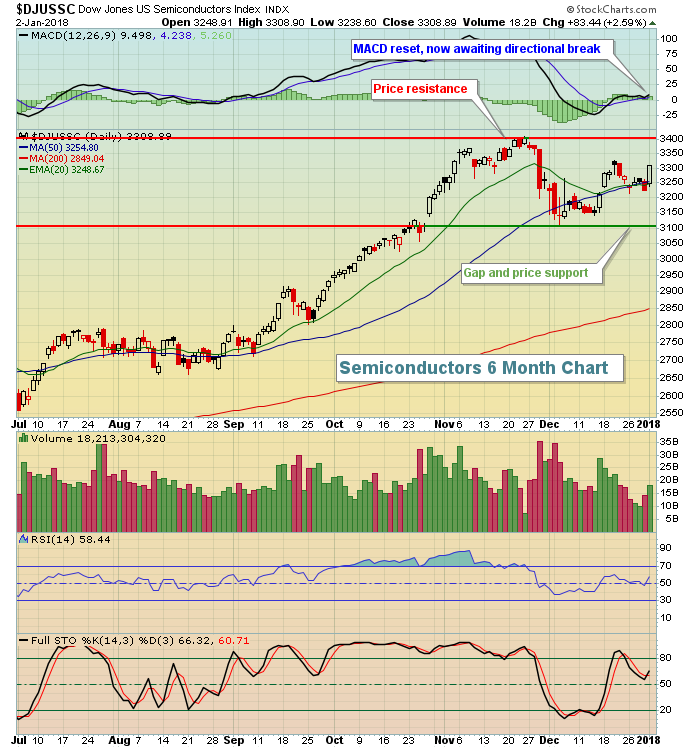

Market Recap for Wednesday, January 10, 2018 We saw losses across our major indices on Wednesday, but the bulls spent most of the day recovering from steeper losses just after the opening bell. Losses were inconsequential as they ranged from 0... Read More

Trading Places with Tom Bowley January 10, 2018 at 09:00 AM

Note At the bottom of this article, you can type in your email address and hit the green "Notify Me" button to subscribe to my blog for FREE! Then my article will immediately be sent to your email address upon publishing... Read More

Trading Places with Tom Bowley January 09, 2018 at 08:55 AM

Market Recap for Monday, January 8, 2018 After mostly a weak start on Monday, our major indices resumed their bullish ways and finished with positive returns. The lone exception was the Dow Jones, which dropped 13 points to end its impressive winning streak to open 2018... Read More

Trading Places with Tom Bowley January 08, 2018 at 08:41 AM

Market Recap for Friday, January 5, 2018 Not even a disappointing jobs report on Friday could slow down this bull market train. U.S... Read More

Trading Places with Tom Bowley January 05, 2018 at 09:00 AM

Market Recap for Thursday, January 4, 2018 Where's the top? Who knows and the bulls don't seem to care. As of Wednesday, the Dow Jones was left out as the only index not to clear a psychological or significant price level for the first time ever in 2018... Read More

Trading Places with Tom Bowley January 04, 2018 at 09:00 AM

Market Recap for Wednesday, January 3, 2018 We're only two trading days into 2018 and already we've seen the S&P 500's first close ever over 2500, the NASDAQ's first close ever above 7000, the Russell 2000's first close ever above 1550... Read More

Trading Places with Tom Bowley January 03, 2018 at 09:00 AM

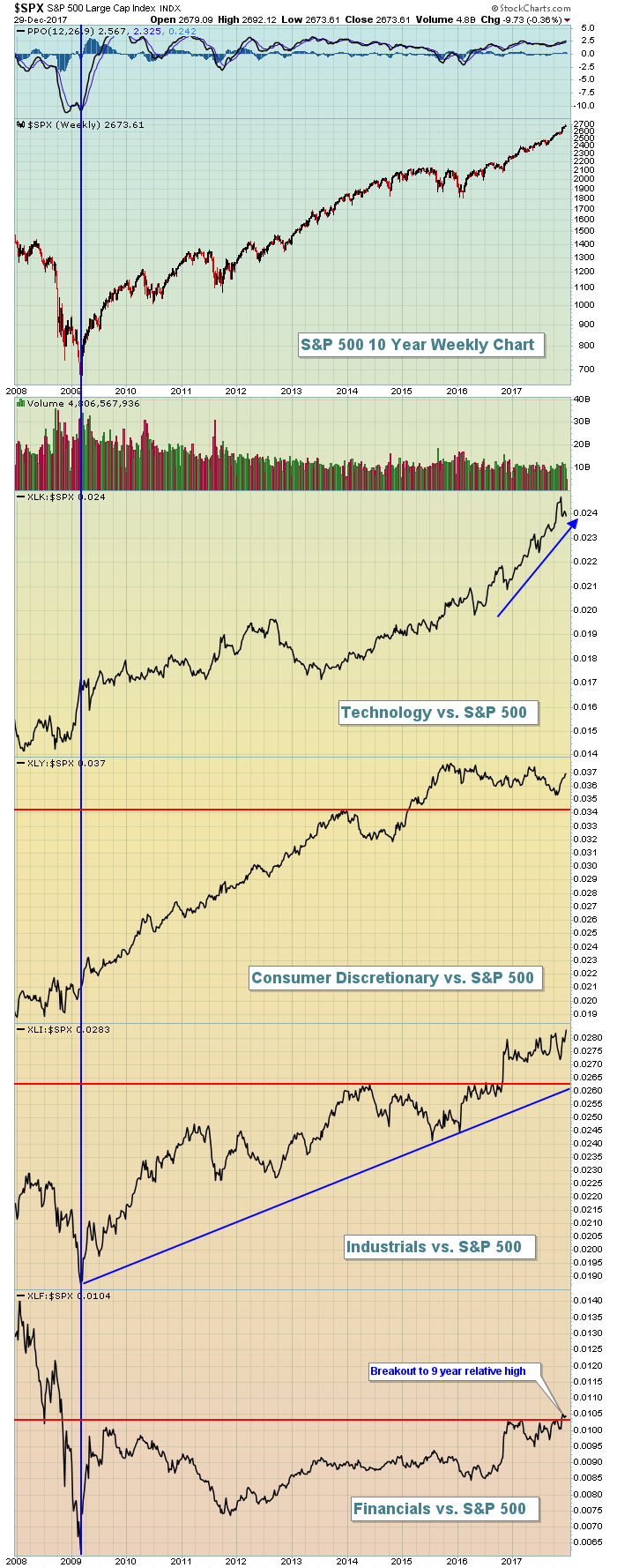

Market Recap for Tuesday, January 2, 2018 The NASDAQ loves January and January loves the NASDAQ. If there's one month where the NASDAQ really shines on a relative basis, it's January (see Historical Tendencies below) and that index opened the new year like it owns January... Read More

Trading Places with Tom Bowley January 02, 2018 at 09:00 AM

Special Note First, I'd like to wish everyone a Happy New Year! Let's make 2018 our best yet! Here are a couple of quick reminders: (1) If you like my Trading Places blog and you'd like to follow my articles every morning, scroll down to the bottom of this article, type in your e... Read More